Investing as a teenager or young adult is an INCREDIBLE way to build your wealth and prepare for your future. Unfortunately investing under the age of 18 can be difficult, not impossible, but there are more hoops to jump through. With that being said, these hoops are absolutely worth the trouble because time is one of the most influential aspects of investing returns, and how much money you make in the long run. In this guide I will explain the basics of investing as a teen or young adult.

Before we really dig in I want to talk about investing as a whole. Investing is one of my greatest passions, I find the topic incredibly interesting and have been researching it since I was 8 years old. Investing is one of the most incredible ways to prepare for your future as a teenager or young adult, because of time and compound interest

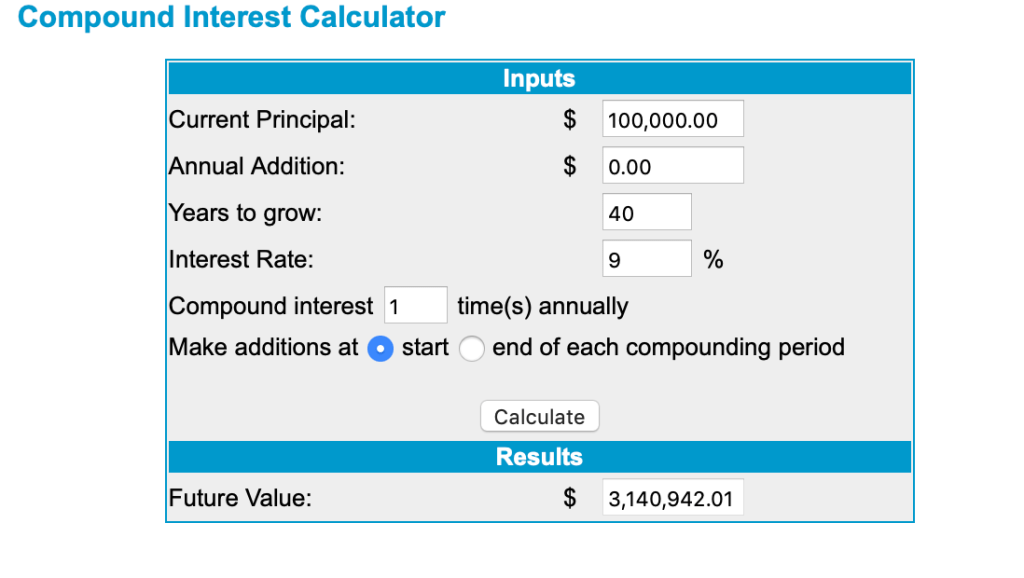

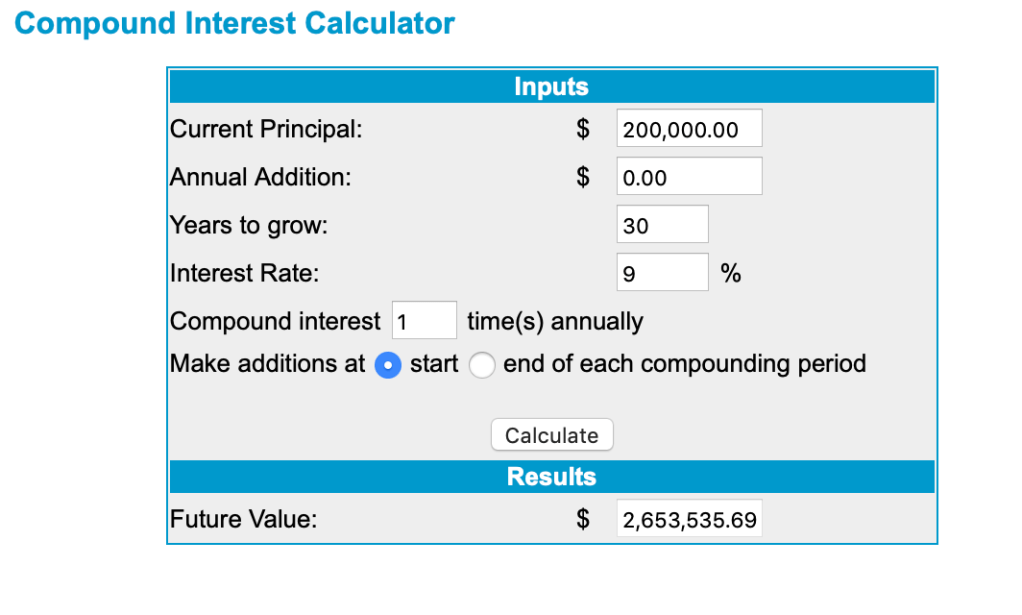

- Time: Time is the single largest factor to help your money grow! if you invest a smaller initial amount, but it is invested longer it will grow and turn into a larger amount of money than a larger initial amount invested for a shorter time. It is difficult to explain in words so lets use this example instead: if Jake makes an initial investment of $100,000 in the stock market, earning on average 9% interest per year for 40 years it will grow into $3,140,942.01, but if Jane makes an initial investment of $200,000 with the same 9% return, but she only invests it for 30 years it would tun into $2,653,535.69 even though Jane invested double what Jake invested she made almost $500,000 less than Jake! I used the “money chimp” compound interest calculator for both of these examples. Here’s a link: http://moneychimp.com/calculator/compound_interest_calculator.htm

- Compound Interest: Compound Interest: Because of our age another aspect we have an incredible advantage in is compound interest. Albert Einstein has a famous quote that summarizes compounding interest perfectly: “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it. Now let’s define compounding interest: “Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest of previous periods of a deposit.” Basically compound interest is when you earn interest on the principal you invest PLUS the interest you earn and that interest. For example: in our previous example Jake made a principal investment of $100,000 and earned 9% interest annually, so after the first year he had $109,000 but after his second year he is earning interest on the $100,000 AND the $9,000 so his after the second year he has $118,810 As you earn more and more interest you will make even more interest on that interest and the loop continues. In this example the change is small but on a large scale this becomes POWERFUL. Compound interest is the real reason why time affects investments so drastically, the longer money is invested the more powerful compound interest becomes.

Investing accounts: Before you actually start buying bonds or stocks you have to have an account to buy them and hold them in. Investing is a complicated subject and one of the most intricate subjects within investing is what type of account you hold your investments in. There are many types of accounts and even apps you can use to invest with. For this article we will focus on three types of accounts: Apps, IRA’s, and (UGMA’s and UTMA’s.) Technically UGMA and UTMA’s are different, but for our purposes I am grouping them together because they are very similar.

- Apps: Investing apps are an incredible way for teens and young adults to invest. Stockpile is currently the largest app that allows minors to invest. If you are over the age of 18 then you can also youse Acorns, Robinhood, or Stash. The reason Stockpile is so great for young investors is the ability to buy fractional shares of your favorite companies. For example: currently (Dec, 2019) amazon is trading at $1,760.94 per share, so if I was on any other trading platform I would have to have $1760.94 before I could buy one share of amazon! most teenagers and young adults don’t have that kind of money just lying around, but with Stockpile you can buy a portion of that share, so lets say you only have $100 to invest, Stockpile will allow you to buy only $100 worth of amazon stock which is about .06 of a share. This ability allows young investors who don’t have tons of cash, to buy the stocks they want to buy, instead of settling for a different stock.

- IRA’s: This is my preferred way to invest as a teenager due to the tax advantages. Although it is important to note that you have to have an earned income to use one of these accounts. IRA stands for “Individual Retirement Account.” An IRA is an investment account used only to invest for retirement. There are two main types of IRA’s: a “Roth IRA” and a “Traditional IRA.” Both of these accounts are used for retirement investing, so when money is invested in one these accounts, it has to stay in the account until you reach the age of retirement which is 59 1/2 years old, if the money is removed early it will be penalized by a 10% tax. Roth IRA’s provide the best tax benefits and advantages; however, some people have specific reasons for using a Traditional IRA over a Roth IRA. The basic difference between the two accounts is when your money gets taxed, in a Roth your money is taxed when you put it into the account and is not taxed when the money is removed, vs. a traditional IRA that taxes your money when you take it out of the account and not when you add it into the account. Although this seems like a minor difference it is actually quite important. The reason why is because your money is going to grow massively inside the account. I recommend reading Investopedia’s article on Roth IRA’s because it is far to difficult to explain in this article. Here’s a link: https://www.investopedia.com/can-teenagers-invest-in-roth-iras-4770663

- UGMA’s and UTMA’s: These accounts are basically just custodial accounts for people under the age of 18, Here’s a link to explain these accounts: https://www.thebalance.com/beginners-guide-to-ugma-and-utma-custodial-accounts-4060475

Now that we are past the boring part we can start talking about how to actually invest! Once you have your account open you have to decide what kinds of funds you are going to purchase inside of your account.

Types of investments: Now let’s start talking about the ways you can actually invest. There are many many different ways to invest, but we will focus on the three largest forms: Stocks, Index Funds, and Bonds.

Stocks: Companies issue stock to raise money. When someone buys a share of stock they are giving their money to the company and in return they receive a very small portion of ownership in the company (technically this depends on if it was bought in the secondary market or the primary market, but for this guide we will not worry about this.) Most companies issue millions and millions of shares so it takes an incredible amount of money to own a meaningful amount of a company.

Index Funds: An index fund is a type of mutual fund with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund is said to provide broad market exposure, low operating expenses and low portfolio turnover. These funds follow their benchmark index no matter the state of the markets. An index fund trades like a stock, but it is actually a cumulation of multiple stocks.

Bonds: A bond is just a loan, when you buy a bond you are loaning the money to the issuer of the bond and after a determined amount of time your money will be paid back to you plus interest. companies issue bonds (corporate bonds) and governments issue bonds (government bonds or treasury bonds.) with bonds you do not own a piece of anything, you are only loaning money. Bonds are typically considered the less risky of the three types of investments.

Typically the more risk involved with your investment, the higher rate of return you will make. For example if you only invest in stocks you will probably make a larger return than someone who only invests in bonds. Although you can never be sure this is true most of the time. As teens and young adults we can use this risk to our advantage. Since we have such a long time to hold our investments we can increase our risk, my personal investment account is made up of 100% stocks and as I move closer to retirement I will start transitioning to a 75% stocks and 25% bond make up for my portfolio and continue shifting more and more toward bonds. This is because when I am young it does not matter if the market collapses and I lose a large portion of my portfolio, because I have more than enough time to regain my money, but if Liam two years away from retirement and I still have 100% stocks and the market collapses I have very little time to regain that money.

This completes my basic guide to investing, I did not want to go too in-depth, instead I wanted to explain the main topics so that you have the building blocks to continue learning about investing. If you wish to continue learning I highly recommend using Investopedia.com, research each of the larger specific terms I used in this article and you will learn great deal about investing.I can not emphasize how incredible the opportunity to invest as a teenager or young adult truly is. The advantages that we have because of our age are unique and powerful, I highly recommend investing as a teenager!

I am not an investing professional or a financial advisor. this article is for learning purposes only, this article is not financial advice and any actions taken by the individuals who read this article are not my responsibility.

One thought on “How to Invest Effectively Under the Age of 25”